4.1 5G monetisation will require migration to the cloud-native core

All three of the additional returns listed in the previous section will require a migration to 5G SA, and in particular to a cloud-native, sliceable, converged core network. We believe that operators that accelerate their deployments of the sliceable core, even if that involves a certain level of risk due to being an early adopter, will have the greatest success with 5G. The risk due to being an early adopter will be offset by the ability to offer a wide range of new services at an earlier stage than their competitors, as long as they prepare well and work with trusted partners.

The benefits of the sliceable core, combined with upcoming updates to the 3GPP standards (Releases 16 and 17), include the following.

- Full automation with an agile, dynamic response to changing user requirements and traffic patterns in order to improve the user experience while boosting resource efficiency for the operator.

- Support for additional connectivity capabilities, enabled in Releases 16 and 17, including ultra-low latency (ULL), massive device and sensor density, large-scale carrier aggregation (including unlicensed spectrum) and 5G-IoT. These allow for the optimised support of a wide range of new or emerging use cases, especially in industrial and IoT environments.

- The ability to carve out a virtual slice of the network for a particular use case, industry or, eventually, individual customer. This can be configured on-demand with the capabilities that each particular use case requires (for instance, a combination of high bandwidth and low latency), and the connectivity can be associated with other functions such as edge computing. This allows operators to support a very wide range of use cases and enterprises from a single platform, thereby improving scalability, flexibility and costeffectiveness.

- Automated and scalable aggregation of many resources. The wider platform that operators will build around their 5G core and RAN will enable them to include other in-house or third-party resources (such as edge compute nodes) into their slices and to on-board a wide range of developers and other partners to provide the richest offerings possible from a single platform.

These capabilities greatly improve the business case for operators to address a wide range of enterprise markets. In the past, operators would have needed to build and run a dedicated network to meet the challenging demands of a customer such as a public safety agency, whose requirements for critical availability would be impossible to guarantee on a shared public network. Operators also needed to build channels to market, partnerships and ecosystems for each vertical industry, which was rarely justified by the amount of additional revenue available.

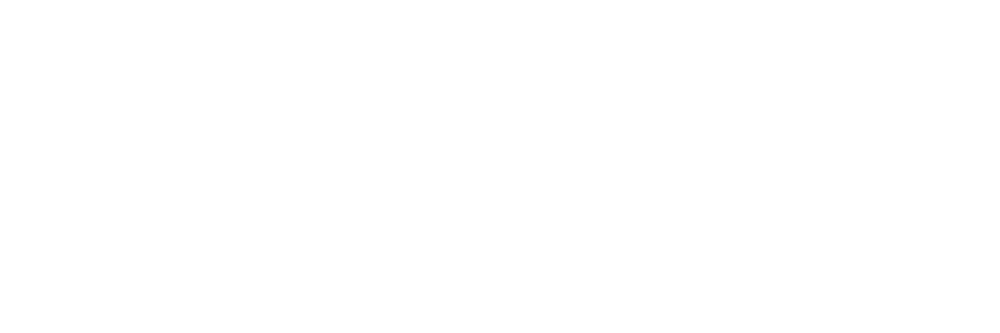

In the 5G era, many industries want to use 5G for more-strategic, high-value purposes than just mobile communications between staff, and they include the technology as part of their own digital transformations. The addressable market for 5G services will grow significantly throughout the 2020s, and operators will be better equipped to take advantage of this if they can support huge numbers of use cases, specialist network requirements and partners from a single automated platform. Figure 6 illustrates the power of this sliceable platform.

Figure 6: Overview of a programmable, sliceable 5G network in which key technology enablers are brought together to support a wide range of industries and use cases. Source: Analysys Mason, 2020

Figure 6: Overview of a programmable, sliceable 5G network in which key technology enablers are brought together to support a wide range of industries and use cases. Source: Analysys Mason, 2020

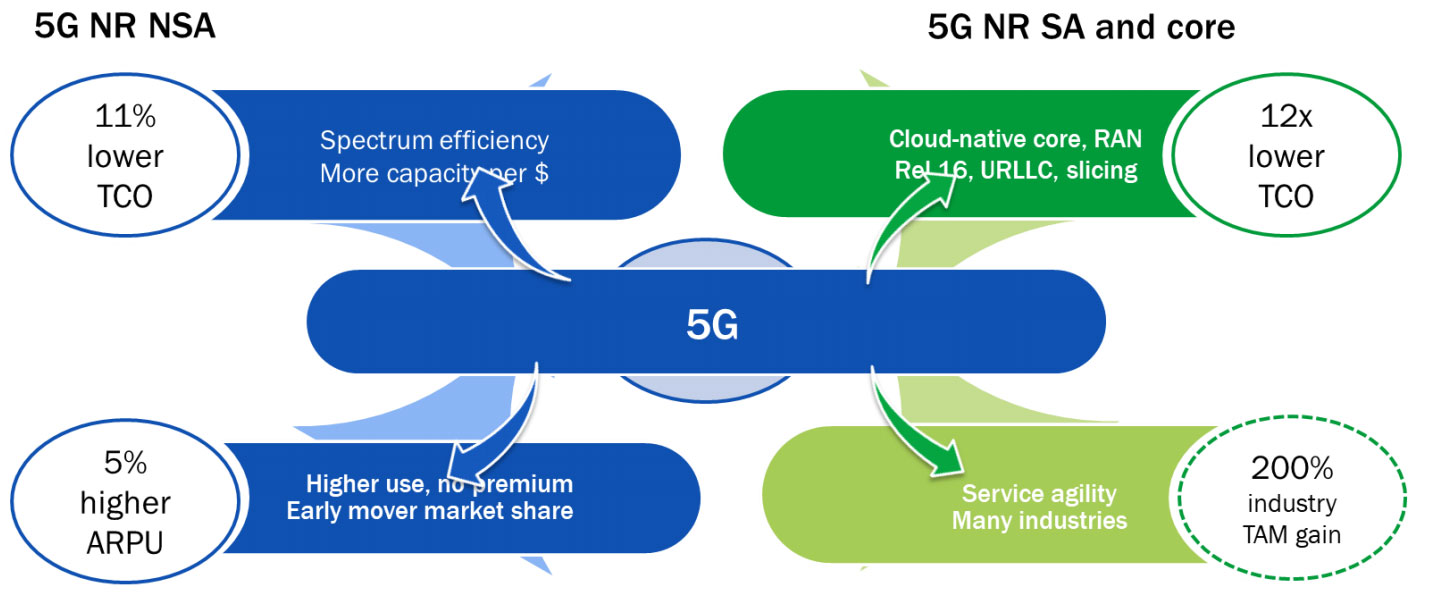

Figure 7: Shows how the operators in our survey believe that the scope of their ambitions will grow as they deploy the SA network and cloud-native core. This migration will be far more challenging than that to NSA, and so operators require far greater returns to justify it. However, the maximum revenue and transformation potential of 5G will only be realised with the full 5G SA platform. Source: Analysys Mason, 2020

Figure 7: Shows how the operators in our survey believe that the scope of their ambitions will grow as they deploy the SA network and cloud-native core. This migration will be far more challenging than that to NSA, and so operators require far greater returns to justify it. However, the maximum revenue and transformation potential of 5G will only be realised with the full 5G SA platform. Source: Analysys Mason, 2020

The survey results show that operators typically expect that 5G NSA will bring lower TCO (mainly achieved with spectral efficiency) and modest increases in ARPU. Operators expect that 5G SA will bring a further wave of TCO reduction enabled by cloud automation, but most importantly, they anticipate that their addressable market will double (on average, in terms of revenue), mainly due to the ability to expand in an agile way into new enterprise, industrial and IoT segments.