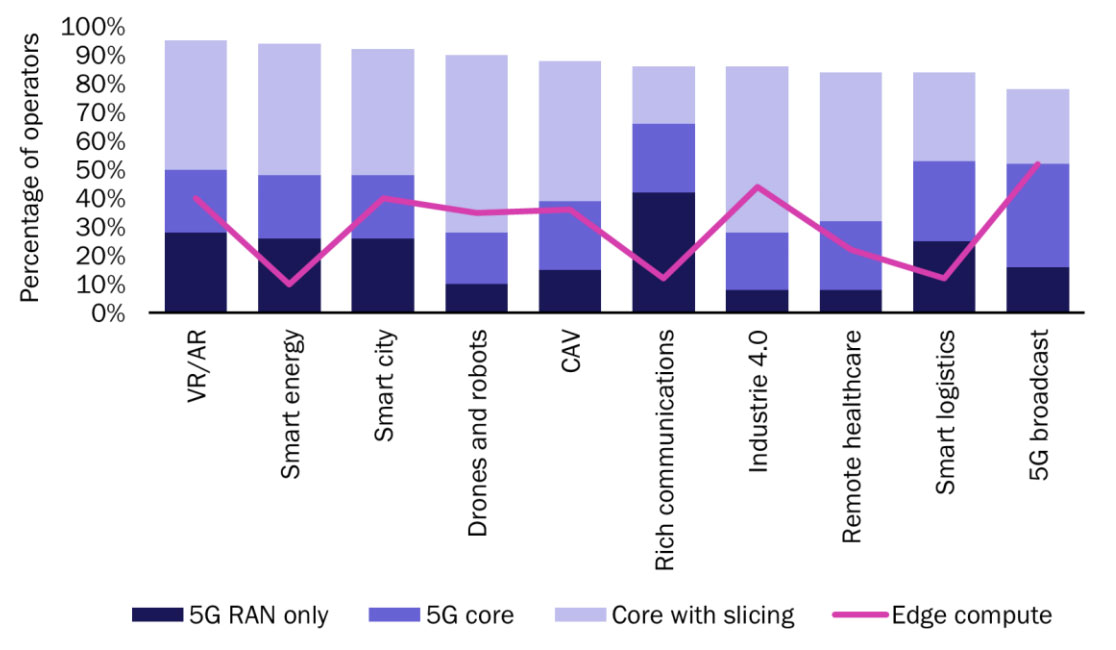

Figure 11 illustrates that the majority of operators believe that a sliceable core will be essential to achieve the quality and reliability that will be needed for commercial success in three of the top ten use case categories (drones and robots, Industrie 4.0 and remote healthcare). Almost half think the same about the three mostpopular use case categories (VR/AR, smart energy and smart cities). At least 40% of operators think that edge computing will be an essential enabler for a successful model based on the broadcast, Industrie 4.0, smart city, AR/VR and CAV use cases.

Figure 11: Percentage of operators intending to support the ten most-cited 5G use case categories, the required enabling 5G network technology for each and the additional importance of edge compute. Source: Analysys Mason, 2020

Figure 11: Percentage of operators intending to support the ten most-cited 5G use case categories, the required enabling 5G network technology for each and the additional importance of edge compute. Source: Analysys Mason, 2020

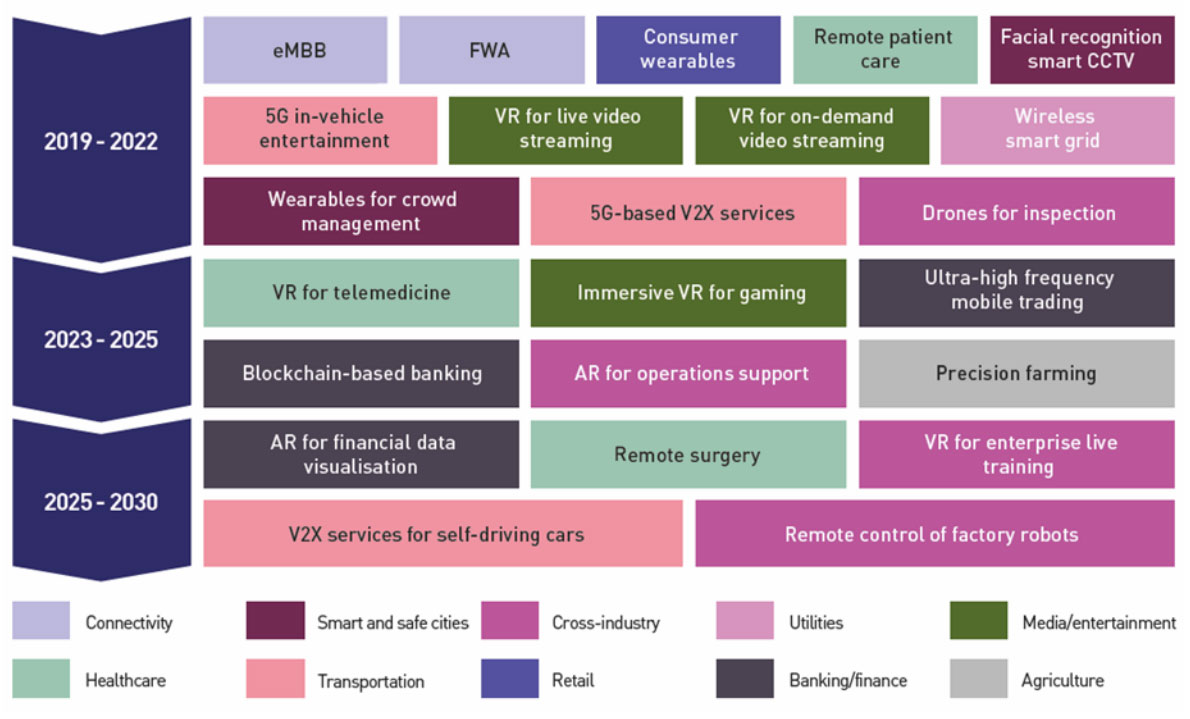

Within these broad categories of use cases, a sliceable platform will provide the versatility to support huge numbers of individual applications for each vertical, many with contrasting connectivity requirements. Figure 12 provides just a sample of the applications that were highlighted in the survey, split by industry and the expected timeline for deployment.

Figure 12: Applications commonly prioritised to enhance the B2B 5G model, by industry and expected timeline for mass deployment, 2020. Source: Analysys Mason, 2020

Figure 12: Applications commonly prioritised to enhance the B2B 5G model, by industry and expected timeline for mass deployment, 2020. Source: Analysys Mason, 2020

5. Conclusion: operators need to decide on their optimal role in the 5G value chain

This paper focuses on the daunting list of important strategic decisions that operators face when considering their 5G business models for the 2020s. These relate to technology, organisation and skills, target markets and priority use cases. All of these aspects will be best-addressed in the context of a broad, programmable 5G platform, as defined in Figure 10, in which open developer frameworks and APIs are combined with fully cloudnative networks running on common cloud infrastructure.

A further set of decisions (which will influence all of the others) relate to the role in the value chain that an operator should play to deliver the best commercial outcome. In these cases too, a platform strategy will help to maximise returns and mitigate risks by providing the highest level of agility to embrace opportunities (even unforeseen ones) as they arise.

The mobile value chain changed between the 2G era and the 4G era; it evolved from the provision of simple voice connectivity to a mobile internet market in which revenue was shared with over-the-top providers. The cloud ecosystem will be an important additional element in the 5G era, and there will be a wide range of partners and competitors in each industry and use case category. For example, the development of AR/VR will introduce new ecosystem players on a horizontal basis, but an industry such as manufacturing or mining will introduce its own specialised set of providers on a vertical basis.

Most operators plan to play a pivotal role in a few value chains (either horizontal or vertical) in which they believe they have particular advantages. The automotive and entertainment verticals, and the AR/VR horizontal, are the most-commonly cited. However, building an ecosystem or securing a high-value role in an existing one requires a considerable investment of effort and resources in order to cultivate partners and support developers. Operators need a platform that will allow them to support the full range of partners, developers and ecosystem players, for any given use case or market, if they are to address a wide variety of industries, and so maximise the monetisation potential of 5G.