3. The 5G RAN without digital transformation will deliver only limited benefits

The foundation stones for a full 5G platform (that is, one that is capable of reducing TCO dramatically while enabling a diverse array of new use cases) are the RAN the 5G core and cloud infrastructure and associated processes. For most operators, the deployment of the 5G RAN in certain locations and applications will be the first step, as outlined above.

To maximise the impact of moving to 5G SA technology with the full 5G core, advanced operators will put cloud infrastructure in place as a precursor to virtualising the core and RAN. Such infrastructure will also allow operators to introduce new levels of automation at each layer of the network in order to make supporting a wide variety of 5G use cases simple and cost-effective. To maximise the impact of this digital transformation, operators will also need to introduce new skills, processes and organisational structures, and should adopt best practice from the IT and webscale worlds, such as DevOps.

3.1 Most operators focus on enhancing existing use cases in the first, NSA phase of 5G

The deployment of 5G NR NSA in the RAN cannot be called ‘full 5G’, as outlined above, though it does have some immediate benefits for the mobile model because it introduces new spectrum capacity and spectral efficiency, and allows operators to differentiate their offerings by improving the quality of experience and supporting enhanced applications.

Some of the earliest movers in terms of 5G NR NSA deployment were the three mobile operators in South Korea (KT, LGU+ and SK Telekom), which announced simultaneous 5G network launches on 3 April 2019. Operators in other countries, such as Rain (South Africa), Sunrise (Switzerland), Telstra (Australia) and Verizon (USA), quickly followed suit. There was at least one operator with a live 5G network in every continent by September 2019. 63 5G handsets had been announced by mid-December 2019.

73 operators in 41 countries have launched commercial 5G as of the start of April 2020. In most cases, they have not yet moved onto subsequent deployment phases of 5G. Only just over one third of the operators with commercial 5G services say that they have already implemented telco cloud infrastructure and processes that are capable of supporting a 5G core and RAN. Only a few select operators (such as Telstra) have a commercial 5G core in place (about 5% of the total).

The business cases of these relatively modest 5G implementations remain primarily focused on enhancing mobile broadband (MBB) services for established target user bases, improving the cost-efficiency of delivering these enhanced services and driving customer adoption with the availability of new devices and improved speeds and quality of experience (QoE).

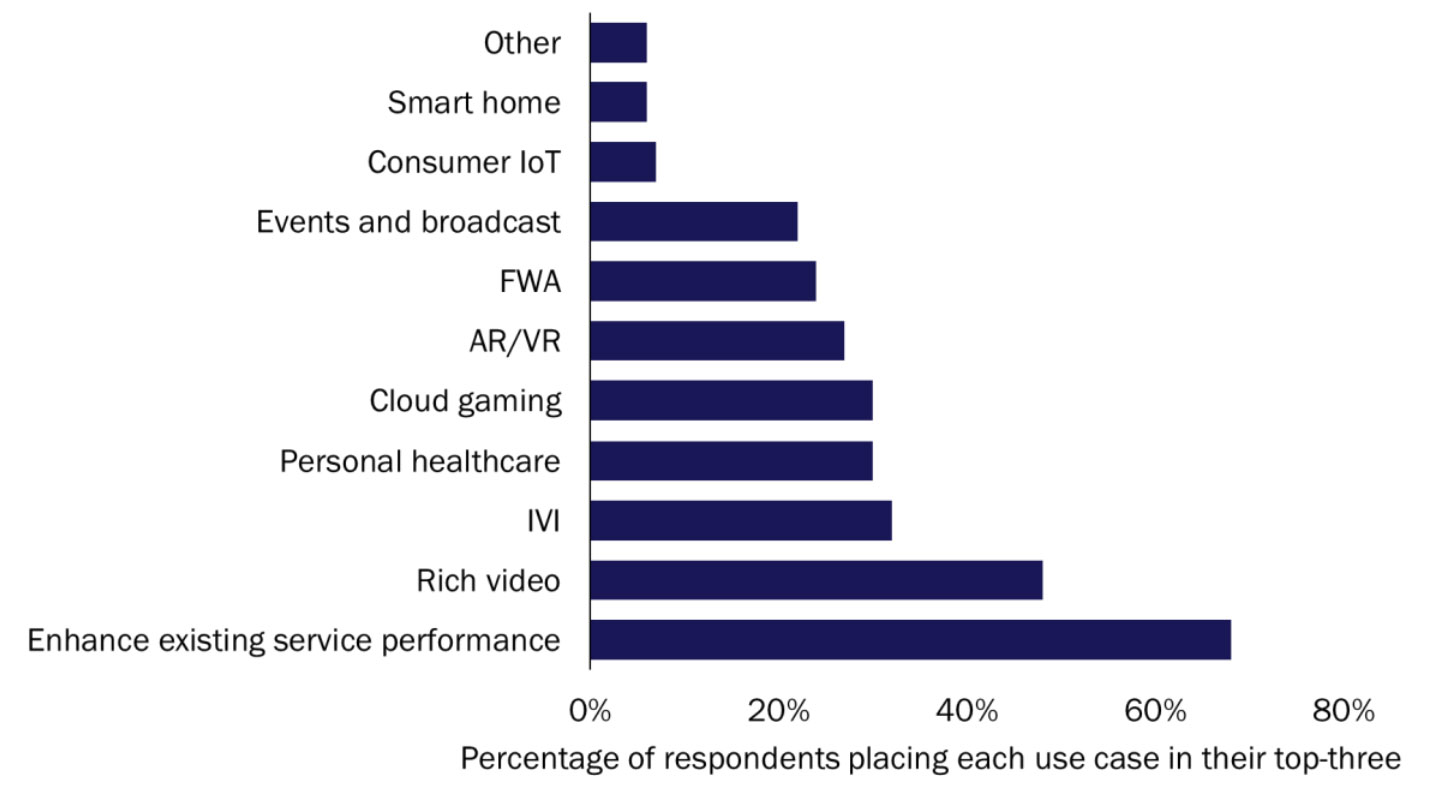

Figure 3 shows the commercial priorities, in terms of use cases, for the typical operator’s first stage of 5G deployment. A panel of 78 Tier-1 and 2 operators were asked to name the three most important use cases that they would support with their 5G NR NSA network in years 1–3 of commercial availability. One of the topthree priorities for two thirds of respondents was simply to enhance the performance and quality of existing applications, for instance by increasing headline data rates to support faster video downloads or better-quality streaming.

Figure 3: Top-three use cases for the first phase of 5G deployment in terms of their importance to the 5G business case, Tier-1 and 2 operators in developed economies, 2Q 2020. Source: Analysys Mason, 2020

Figure 3: Top-three use cases for the first phase of 5G deployment in terms of their importance to the 5G business case, Tier-1 and 2 operators in developed economies, 2Q 2020. Source: Analysys Mason, 2020

Most of the other use cases that were heavily prioritised are extensions of existing services. For instance, almost half of the respondents believe that it will be commercially important not just to improve video speeds, but to add rich video effects such as greater immersiveness, in order to drive customer usage, satisfaction and stickiness.

Other important use cases enabled by the first stage of 5G deployment include services for in-vehicle infotainment (IVI), personal healthcare and fitness, cloud gaming and augmented reality/virtual reality (AR/VR). In many cases, operators are already offering these applications on 4G (and continue to do so), but they can be greatly enhanced for 5G users. For example, about 70% of respondents are already supporting some AR applications on 4G, and two thirds of those expect to add 5G-enabled enhancements in the first year of their 5G roll-out, though only 27% of all respondents rate AR/VR as a top-three commercial opportunity for 5G NR NSA.

This rating will change significantly with the introduction of the 5G core, as we will see in the next chapter; at that stage, almost half of all operators will consider AR/VR to be a top-three opportunity. This highlights the greater potential that operators will have to build on 5G capabilities and monetise them effectively once they have a 5G core.