2. Operators are moving to the critical second phase of 5G

History tells us that, while the first phase of deployment of a new technology may attract much of the attention and excitement, the critical period for an operator’s business comes with the second phase. There are greater opportunities to transform the business model as the technology evolves, but there are also higher risks because the operator typically takes on greater architectural change and moves out of its service comfort zones.

This was true, for instance, when operators enhanced their 3G networks by adding HSPA. This will be even more true for 5G than for previous generations, because operators’ business drivers are changing. Revenue growth for operators in mature economies is typically slowing as conventional mobile broadband and consumer markets become saturated. However, they need to keep upgrading and expanding their networks in order to meet the rising demands for data speeds and quality of experience.

This means that that 5G must deliver on two key commercial imperatives. It must:

- reduce the total cost of ownership so that conventional services can be delivered and upgraded at a lower cost per subscriber, thereby maintaining profit margins even if ARPU growth has stagnated

- support the diversification of revenue streams (including new consumer experiences such as advanced incar services) by enabling a wide range of enterprise, industrial and IoT use cases to be targeted.

2.1 The first 5G phase brings some immediate but modest benefits

An analysis of the commercial 5G deployments since late 2018 shows that the first-phase networks will only deliver on these key objectives to a limited extent. The first wave of 5G build-outs rely on 5G NR NSA technology, which allows 5G base stations to be added to a 4G network and core. This has various advantages for the operator, including the following.

- 5G NR NSA is relatively simple to deploy, since there is no need to go through the complex migration to a cloud-based 5G core immediately.

- It can make use of many existing network assets such as the 4G site grid, while boosting capacity and data rates by adding new spectrum (mainly in the 3.5GHz band) in selected areas of high usage.

- There is no need to build nationwide 5G too rapidly since 4G continues to provide broad coverage; operators can align their build-out with areas of demand.

This fairly cautious upgrade strategy has immediate commercial benefits. The marketing associated with a 5G launch (along with new devices and faster headline speeds) can help to attract market share, especially for first movers in a market. The capacity boost can support new and/or improved user experiences in areas such as video streaming and augmented reality, which can also help with KPIs such as market share and churn reduction.

However, our research shows that these new capabilities have largely been delivered to improve services for existing target user bases, rather than to extend the business model significantly. As a result, the commercial impact has so far been limited.

- The launch of brand new services and revenue streams enabled specifically by 5G has been rare in the first 18 months, with the exception of fixed wireless access (FWA) launches in some countries such as the USA.

- Some operators, such as AT&T, have reported reductions in the cost to deliver 1GB of data as a result of implementing 5G NR NSA, but lower network costs have often been offset by other costs associated with a 5G launch, such as marketing.

- A few operators have been able to increase tariffs following a 5G launch, at least while they remained the first 5G provider in the market (such as EE in the UK). However, in most cases there has been no 5G premium, and KPI improvement has come from higher usage levels that have driven consumers to higher pricing tiers (as was the case for T-Mobile Germany). SK Telecom in South Korea said that its ARPU rose by 1.7% in the first three quarters of offering 5G services, but its operating profits were down by 50% yearon-year in 2019, largely because of the costs of 5G build-out and marketing.

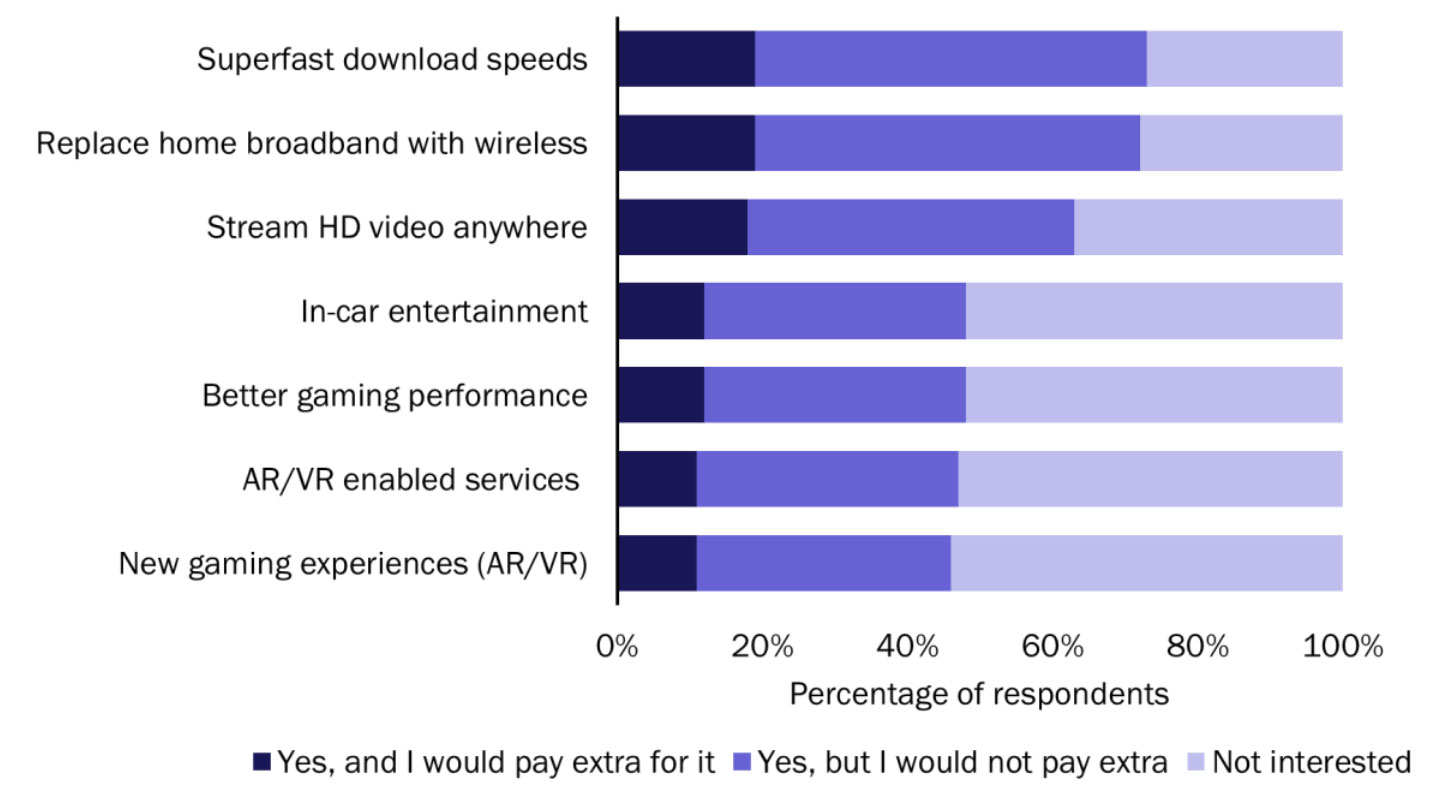

- Analysys Mason’s global consumer survey indicates that the interest in 5G-enabled services is high, but the willingness to pay extra is limited (Figure 1).

Figure 1: Interest in 5G-enabled services according to our Connected Consumer Survey, Australia, Europe, New Zealand and the USA, 2019. Source: Analysys Mason, 2020

Figure 1: Interest in 5G-enabled services according to our Connected Consumer Survey, Australia, Europe, New Zealand and the USA, 2019. Source: Analysys Mason, 2020