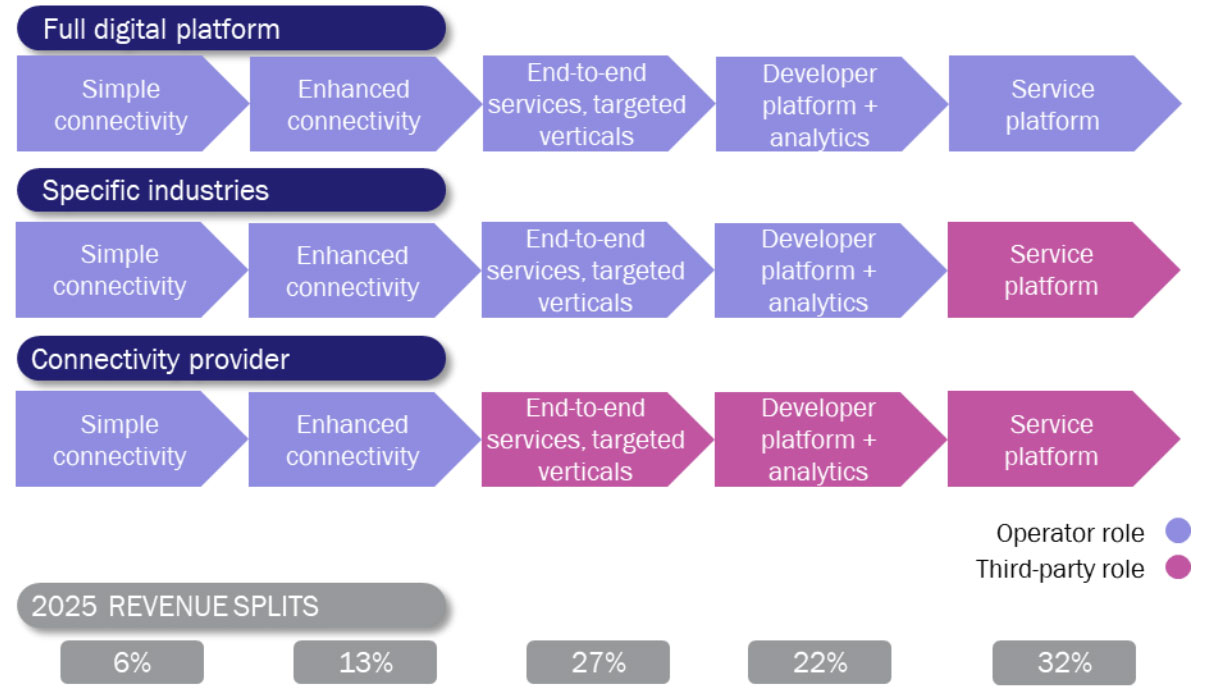

This will enable them to address the entire value chain, and Analysys Mason estimates that 50% of the revenue in that chain in a developed mobile market in Europe, North America or Australia will potentially be available to operators (the rest will be divided between players such as developers and cloud partners).

The roles that are typically available to operators in an enterprise value chain are visualised in Figure 13, for each of three common business models. The main options are to offer:

- basic and enhanced connectivity (the latter including, for instance, added-value network-based services such as security, or special capabilities such as ULL)

- vertical-specific end-to-end network services such as robot operations

- an applications and analytics platform to support many developers

- a full service platform that supports all players in the value chain from a common, flexible foundation.

Figure 13: B2B 5G value chain roles that are open to operators for three different business model scenarios, and the 2025 revenue split for each link in the chain. Source: Analysys Mason, 2020

Figure 13: B2B 5G value chain roles that are open to operators for three different business model scenarios, and the 2025 revenue split for each link in the chain. Source: Analysys Mason, 2020

This leads us to make the following key recommendations for operators in developed markets as they make their next critical decisions about their 5G business models.

- Operators should deploy the cloud-native core and network slicing early to achieve the strongest differentiation.

- Operators should form strong partnerships in the 5G enterprise value chain, even if this diminishes their role.

- Operators should change their investment priorities to protect their margins. Co-investment, digital skills and ‘brutal automation’ are key.